Summary:

Profitability of climate actions depends critically on the chosen discount rate. If the rate is high, it is very difficult to push forward projects whose benefits span over generations.

Full text:

What is the essence of the economic problem posed by climate change? The economic uniqueness of the climate-change problem is not just that today’s decisions have difficult-to-reverse impacts that will be felt very far out into the future, thereby straining the concept of time discounting and placing a heavy burden on the choice of an interest rate. Nor does uniqueness come from the unsure outcome of a stochastic process with known structure and known objective-frequency probabilities. Much more unsettling for an application of (present discounted) expected utility analysis are the unknowns: deep structural uncertainty in the science coupled with an economic inability to evaluate meaningfully the catastrophic losses from disastrous temperature changes.: Martin Weitzman (2009)

Quite a few of us think we care about the future generations, but what does this actually mean? In order for this to be more than empty talk values should be reflected in deeds. If we try to estimate, for example, profitability of an investment or costs from damages due to climate change, our values are reflected in valuing costs and benefits far in the future as highly as those happening today. In economics this is reflected the the so-called discount rate. It tells how meaningful you think immediate benefit or cost is relative to those happening in the future. If the discount rate were 10%, it means that one euro one year from now, would only be worth 100 cents/(1+0.1)=91 cents to you today. Choosing ”rationally” you would rather accept 92 cents today than wait one year to get one euro. A euro two years from now would be worth even less i.e. 100 cents/(1+0.1)2=83 cents and so on further into the future.

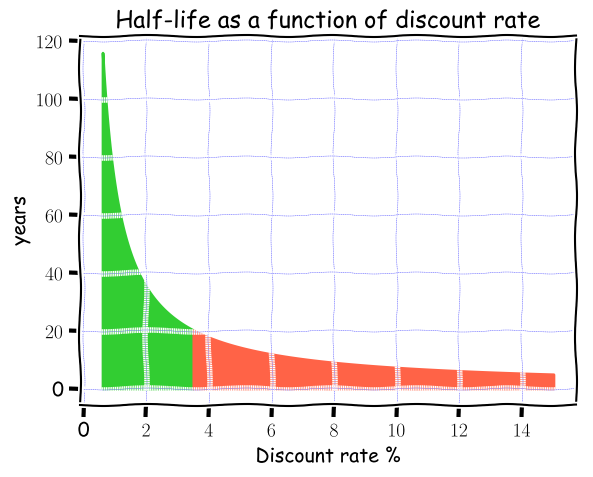

Higher the rate implies impatience — future benefits and costs do not really influence you decisions and your claims of caring about the future generations are without substance. The figure below shows the ”half-life” of the euro as a function of discount rate. Lower rate means, that euro remains meaningful for a longer time. If you want your time horizon to be genuinely intergenerational, you should aim deep into the green region of the graph i.e. the rate used should be clearly below 4%.

Figure 1: If you want to have a time horizon extending across generations, you should aim deep into the green territory.

Unfortunately, climate action is nowadays largely evaluated and modelled with much higher discount rates. For example, the scenarios in the latest IPCC report on 1.5 degrees goal seemed to assume 5% discount rate. In the earlier reports the rate in the integrated assessment models has been 5% or sometimes 10% while the discussion about the problematic ethical implications of these choices were left for other scientists. Obviously the choice of the discount rate does not just influence climate policies, but it has implications whenever one attempts to do cost-benefit analysis. In Finland, for example, use of higher discount rate has driven the logging of younger forests with obvious negative ecological and climate impacts.

Why would anyone choose a high discount rate especially if this has little to do with their cost of capital? How can you ethically justify short sightedness? This can be done by assuming that future generations are much wealthier than we are. We don’t need to care, since they can fend for themselves. Or maybe ”well being” increases more by investing in other things than climate change mitigation, since we guess higher returns on financial markets. Rapidly rising stock markets can then compensate the damage caused by the climate change.

However, this makes implicit assumptions about economic growth as well as about the small size of climate damages. Possibility of a catastrophic risk is excluded and climate change is perceived as an issue that can be addressed with marginal changes which do not have major influence on, for example, economic growth. Growth is assumed to continue so that we can safely extrapolate from the recent past until the end of the century (and beyond). Often those making investment decisions can also assume that they will not be the ones paying for climate change damages. Investor might have to pay if externalities would be prized in. This would, however, imply such a high emission prices that many existing investments and business models would become unprofitable. Investor would rise up to lobby agains such developments.

All of these are drastic assumptions and not ”scientific results”. It is unfortunate how results based on such assumptions are nevertheless paraded in public discussions as ”scientific facts”. Research does not support such certainty. If one reads, for example, William Nordhaus’s documentation for his DICE model it is clear that damage estimates have huge uncertainties:

However, current studies generally omit several important factors (the economic

value of losses from biodiversity, ocean acidification, and political reactions),

extreme events (sea-level rise, changes in ocean circulation, and accelerated climate

change), impacts that are inherently difficult to model (catastrophic events and very

long term warming), and uncertainty (of virtually all components from economic

growth to damages): William Nordhaus (2013)

Once these colossal issues for which it might be impossible to give monetary costs are bypassed, damages are nevertheless estimated with a function where catastrophic 10 degrees warming (agriculture would have collapsed long before this) implies a moderate 25% drop in the GDP. Extrapolation from estimates with small changes cannot be honestly made, but still this happens.

Academic discussion about discount rates has been lively and many are of the opinion that especially decisions spanning generations should be discounted with a low discount rate. Recently deceased well known economist Martin Weitzman has also warned that in the cost-benefit analyses of the climate change the cost of catastrophic risk might be the dominant factor rather than discounting. It is possible that the framework of utility maximing cost-benefit analysis might be inadequate.

Maybe a more sensible starting point could be to look for a balance between two catastrophes — on the other hand the catastrophe to which climate change is driving us and on the other the catastrophe implied by rapid removal of fossil fuels from humanity whose metabolism currently relies on them. Longer we wait, sharper the shock that will eventually release the tension between the disasters becomes. In this situation assumptions about linearity and the usefulness of minor tweaks around existing system might be wrong with high probability. We cannot extrapolate with any confidence from the past into this kind of future and we cannot predict which path between the catastrophes would be ”optimal”. Actions must be taken despite this uncertainty without imagining that extra modelling or arguing about ”damage functions” would change anything of relevance. This is important and extremely interesting, but rather than think about any further, I wish to make few simpler comments on how cost models depend on the discount rate. It is important to discuss this even if one would consider the models logic otherwise solid.

So what difference does the rate make?

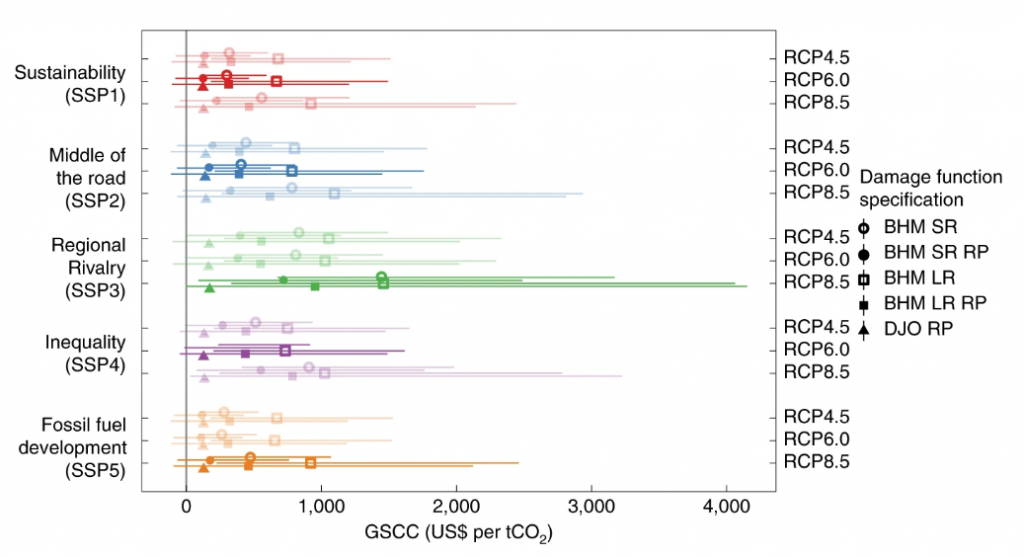

As one estimates, for example, the cost of carbon required for the climate action, this depends sensitively on the assumed discount rate. If one uses low rate, the damage caused by the fossil fuels is estimated to be high. With high rate, discounting effectively eliminates future damages and consequently the cost of carbon is reduced. (Possible exception would be catastrophic damages which are so enermous as to swamp the effects of the discount rate.) If someone claims that adequate climate policies can be promoted with fairly low carbon tax (or equivalent), he/she most likely relies on computations assuming high discount rate and where future climate damages are fairly small and definitely not an existential threat. The chosen rate implicitly buttresses the desired conservative starting point where policy should amount to minor tweaks around existing structures. I warmly recommend the Carbonbrief article discussing this more extensively. When people estimate fossil fuel damages, results are all over the place depending on whom you ask. Below is a figure from a fairly recent paper by Ricke et al. As you can clearly see, results are so scattered that drawing clear policy implications from it becomes well-nigh impossible.

Figure 2: Estimates of the global social cost of carbon All over the place.

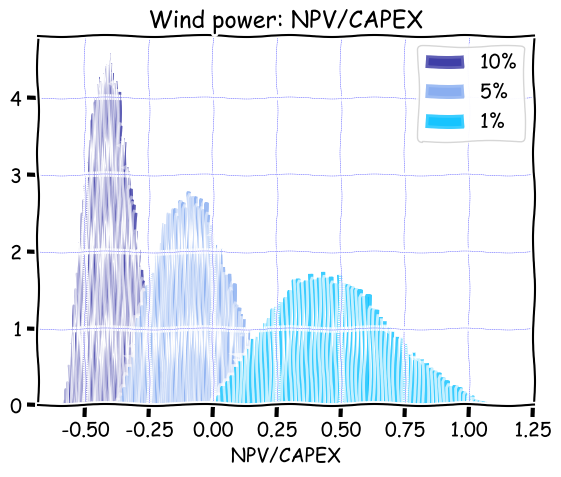

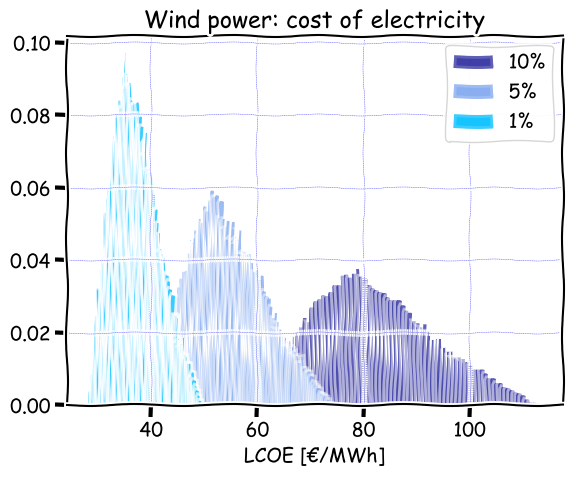

The discount rate used also influences critically the estimated cost of energy and also whether or not the investment is judged profitable i.e. whether its ”net present value (NPV)” is positive.I might return to these issues later and here it is enough to comment that in computing the cost of electricity we sum all the discounted costs of the electricity across the plant lifetime and then compare that with the amount of electricity produced. In computing NPV, one compares all the discounted benefits (electricity sales) with the discounted costs (production costs etc.). If the benefits are larger than costs, the investment is profitable. Next, I will show an example of the cost of wind power (Figures 3 and 4) as well as the corresponding net present value with a few different discount rates. (In the calculations I assumed some range for the uncertain parameters and sampled randomly within that range. The distribution reflects the uncertainty in the results. The jupyter-notebooks I used can be download behind this link..)

Figure3: Net present value of wind power relative to capital expenditure with different discount rates. With high rates investment is unprofitable. (I assumed electricity market price of around 50 $/MWh.)

Figure 4: Almost the same as earlier. Levelized cost of wind power with different discount rates. Note also that lowering the rate makes the distribution more narrow. I.e. it reduces the risks related to project uncertainties.

As is clear by now, the role of the discount rate is central. Lowering it can make seemingly unprofitable investment profitable although realizing these profits requires a longer time horizon and patience. Lowering the rate also reduces project risks, because screw-ups during the construction can be compensated with the benefits one gets over the longer term.

How should one choose the discount rate? Some might think that rate should be the ”market rate”, but typically the rate used in the calculations bears little resemblance to the cost of borrowed capital. Often it seems that the main reason for the choice of the discount rate is custom. ”This is the rate we have always used.” No one gets fired from buying a Windows Office package for the organization and everyone is quiet if you use the same discounting as always. Sometimes discounting is not even chosen consistently, but one chooses whatever discount rate one needs to get the desired outcome. In such cases it is a tool to generate extra confusion.

For the poor who have, by definition, little money higher discounting might be justified. There are plenty of investments that will improve their situation, and consequently, it might make sense to use higher discount rates and in this way promote spending on many less capital intensive projects. A poor country might rationally make different prioritizations in climate policies than richer countries do.

A company might use a higher rate since in the recent past they have gotten corresponding returns from somewhere else. However, this tells us nothing about what future returns will be or whether this choice is useful from the climate policy perspective. Why would, for example, returns on maintaining existing infrastructure tell us something on the returns one can reasonably achieve from replacing most of it? Households might use very high discount rate. Here are some estimates from Denmark with average household rates around 30% so that the rich used a somewhat lower rate than others, and pensioners used especially high discounting which is hardly surprising considering the approaching death. (This also explains some of the dynamics in trying to agree on expensive renovations in housing companies. Old and young people do not have identical interests.)

A state could if it so decides easily take the long view and use a low discount rate. A state that gets free money from the markets could use very low discounting in making choices even without major ethical considerations about responsibilities for future generations. That it doesn’t do so is a political choice. For example, in Finland the Ministry of Social Affairs and health has agreed that health procedures are compared using a 3% discount rate. Also, whoever makes the comparison must also show the results in the absence of discounting i.e. with a zero discount rate. Why is this not a standard also in climate policies?

Discussions about these choices have been largely non-existent. I suspect this is so because it would quickly raise uncomfortable questions about current structures. If a state were to start applying low rates and take an active role in say energy markets, it would start doing huge amounts of investments that from its perspective would be strongly profitable. This would drive the current short-sighted market actors to the margins, transform most of their current plants to scrap metal, and undermine their returns on capital.

For the defenders of status quo, this would of course appear as grossly unfair and they would fiercely lobby against such developments. On the other hand, what do those using high discounting have to contribute to climate policies that truly are intergenerational? To put it bluntly, are they just dead weight for effective climate policies? We can get them to invest only by paying extra subsidies that compensate for the costs that their demands for high returns on capital cause. Why such subsidies should be paid and who benefits from them must be discussed openly. We cannot simply assume that such spending is naturally a good thing. Those resources could be used for other things as well.

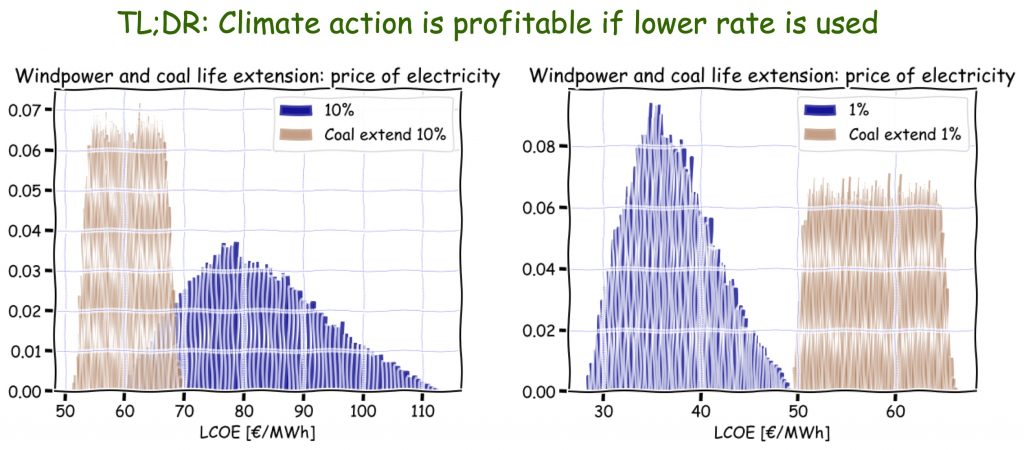

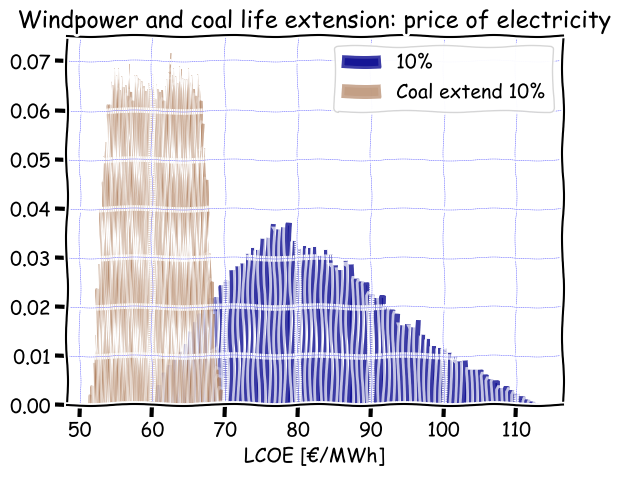

So what kinds of investments do we get with different discount rates? We already saw that lowering the discount rate lowered the cost of wind power, but of course it does the same also for coal power. In the following, I compare how a life extension of a coal plant compares with wind power. Parameters are of course somewhat uncertain since there are many different types of investments, but the basic point remains the same. Maintaining existing infrastructure typically requires less capital than new builds and a high rate favours the options with low capital costs. If we use a 10% discount rate, a lifetime extension for a coal plant easily appears as attractive compared to wind power.

Figure 5: Coal power life extension compared with wind power using a 10% discount rate.

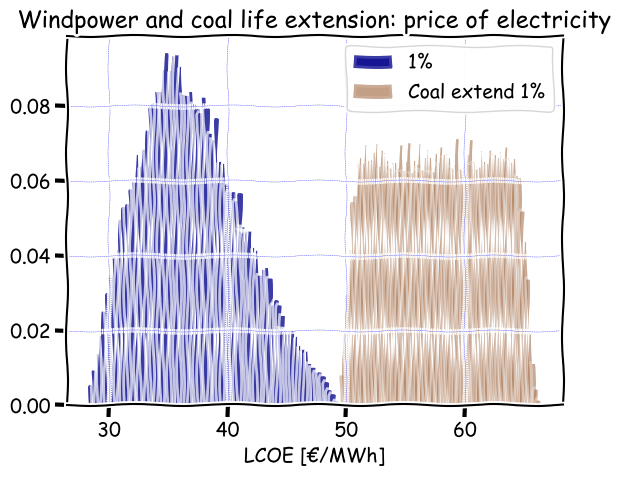

If we lower the discount rate, the situation changes completely. Now wind power is the cheap option and coal extension is questionable. In energy discussions one often quarrels about what energy source to support or reject. This is typically besides the point. What difference does it make that you ”support” some energy source if you are not prepared to support such a time horizon where investments in it are profitable? If you choose structures that favour fossil fuels, and the maintaining of infrastructure associated with them ”support” is not much more than thoughts and prayers.

Figure 6: Coal power life extension compared with wind power using a 1% discount rate.

Implications of these observations for climate policies are of course large. If we build the policies around actors that require the profits implied by high rates, this will be expensive and requires continuous stream of subsidies to drive the transition. This is unlikely to change in the future since the cost structure of low carbon alternatives tend to be dominated by capital costs. Use of high discount rates will imply fiddling around the existing infrastructure and making incremental changes, when fast and deep decarbonization of the whole energy system is required.

Jani-Petri Martikainen

Vice-chairperson for the Green Federation of Science and Technology and lecturer of physics in Aalto University